Mission & Areas of Focus

The Torrington Savings Foundation is dedicated to revitalizing the communities that it serves and improving the quality of life for low to moderate income individuals and families. The Foundation supports grants in the following areas of focus: Affordable Housing, Education, and Human Services and Basic Needs programs.

Affordable Housing

- Community development projects

- Development of low/moderate-income housing

- no pre-development requests

- Maintenance and renovation projects

Education

- Education programs that supplement K-12 classroom activities

- pre-literacy, math, science, arts, and social skills programs that are critical to the childhood experience

- Financial literacy, counseling & training for individuals of all ages

- Business educational programs which support family-run or small business development serving the local community

Note: The Foundation’s primary focus areas are affordable housing and education; however, requests for human services and basic needs will be accepted. Grants will be awarded based on primary focus and available grant funds.

Human Services & Basic Needs

Childcare Services

- Access to affordable childcare, after-school enrichment programs, summer camp programs

Food Security

- Access to local meals, food supplies, nutrition education and awareness programs, school/community gardening programs, agricultural programs

Health Equity

- Aging, home care, mental health, senior services, transportation

Homelessness

- Upgrades to/replacements of facilities or equipment that offer education services, employment assistance and wellbeing programs

Types of Grants

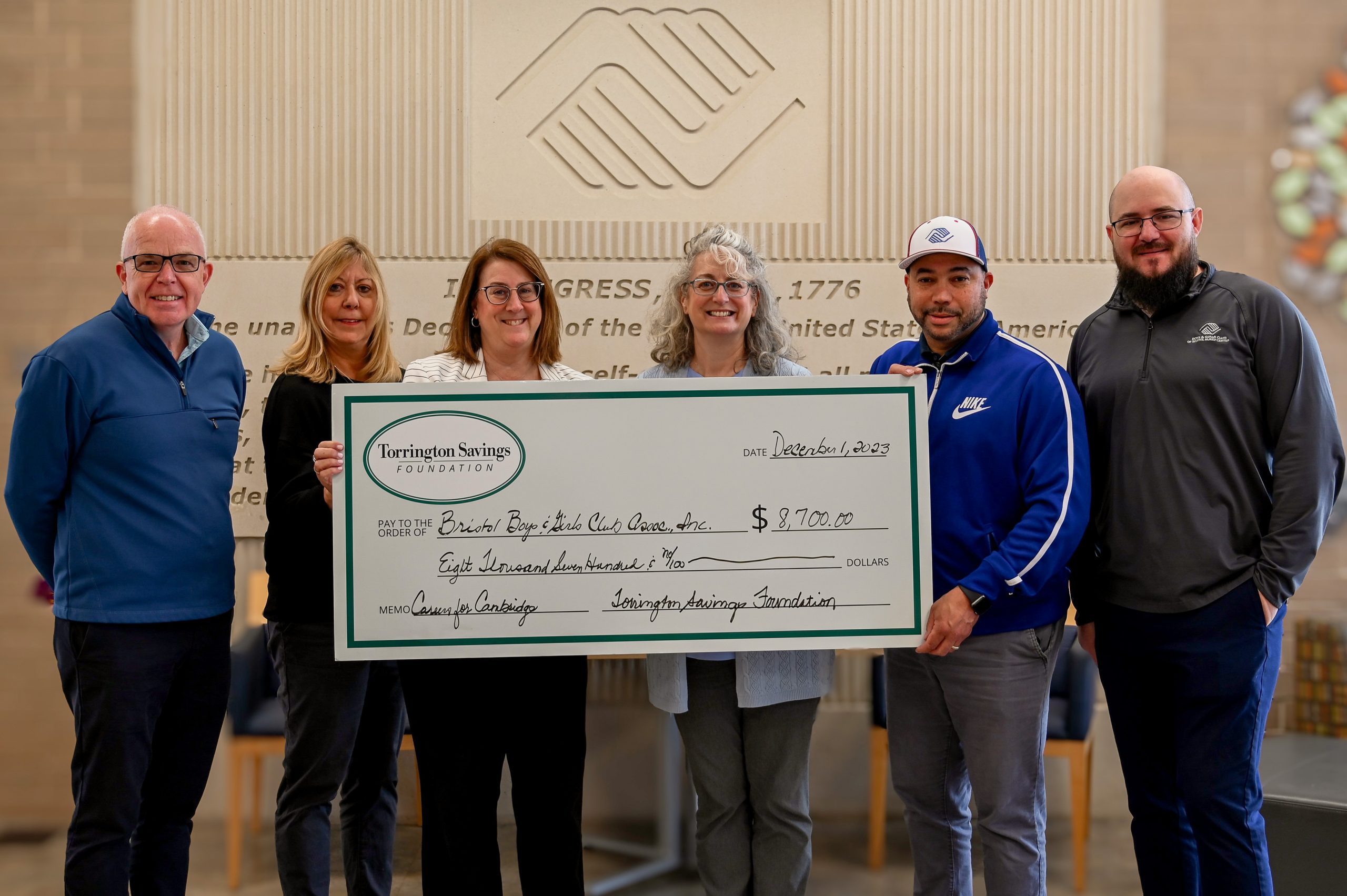

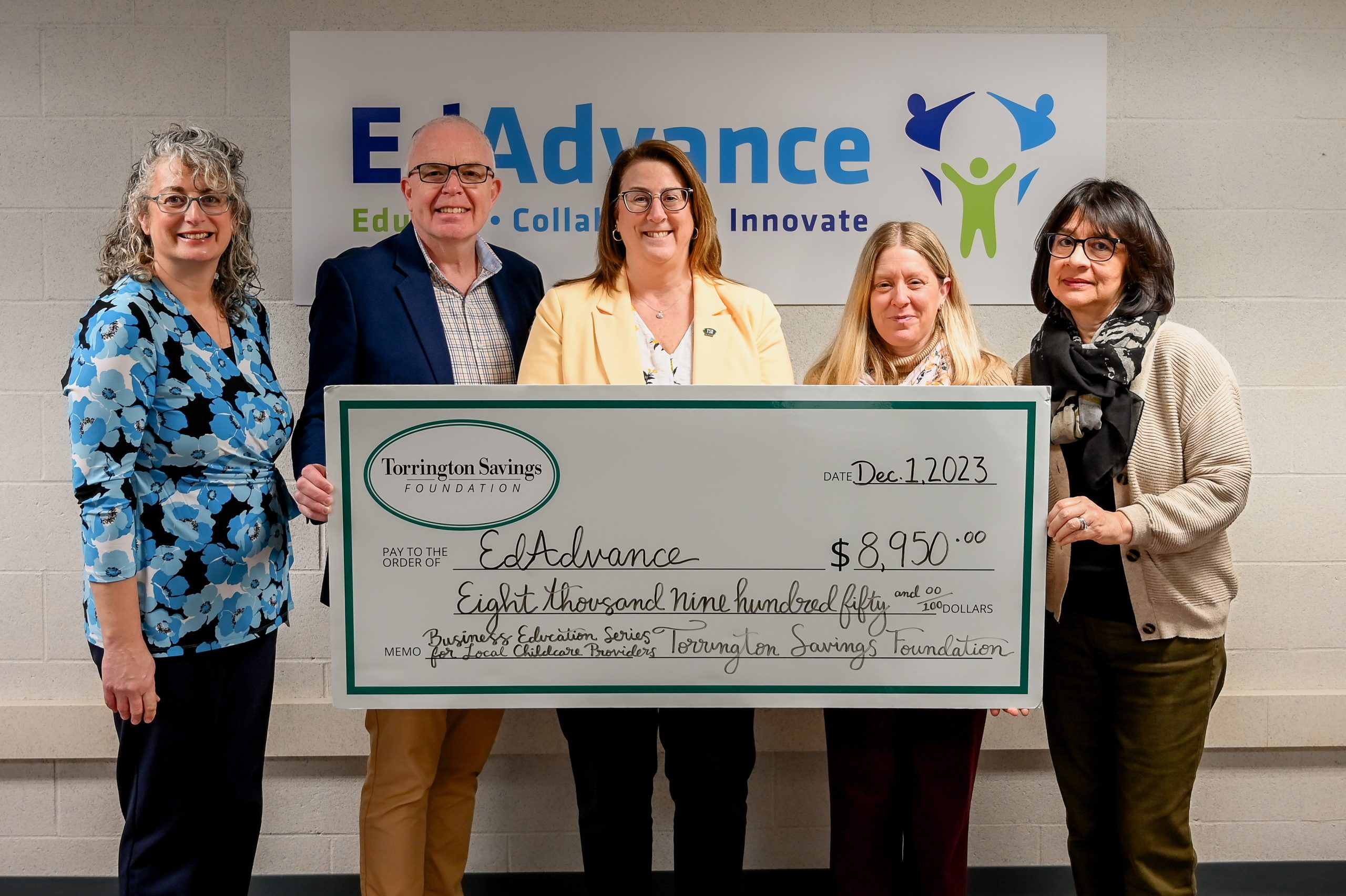

The Torrington Savings Foundation awards both designated and competitive grants.

- Designated grants will be made to organizations selected by the Torrington Savings Foundation and will not be required to submit an application for this funding. The Torrington Savings Foundation will notify the organization of the award and distribution of funding.

- Competitive grants are made for programs and projects that align with the Torrington Savings Foundation focus areas. The focus areas are:

- Affordable Housing

- Education

- Human Services & Basic Needs

The Foundation’s primary focus areas are Affordable Housing and Education; however, requests for Human Services and Basic Needs will be accepted. Grants will be awarded based on primary focus and available grant funds.

Eligibility Requirements

Grantees are invited to apply if they meet the following eligibility criteria:

- Must be located in, or operate in the communities within the Foundation’s defined assessment area as follows:

- Avon, Barkhamsted, Bethlehem, Bridgewater, Bristol, Burlington, Canaan, Canton, Colebrook, Cornwall, East Granby, Farmington, Goshen, Granby, Hartland, Harwinton, Kent, Litchfield, Morris, New Hartford, New Milford, Norfolk, North Canaan, Plymouth, Roxbury, Salisbury, Sharon, Simsbury, Thomaston, Torrington, Warren, Washington, Watertown, Winchester and Woodbury.

- Registered as a 501(c)(3) organization or have a 501(c)(3) fiscal agent/sponsor

- Aligned with our mission and areas of focus

- An active 501(c)(3) organization (min 1 year) that can demonstrate impact to its community

Application Guidelines

In addition to the eligibility requirements, the following guidelines are as follows:

- Only one application per 12-month period may be submitted

- Requests for multi-year commitments will not be considered

- Returning grantees must submit a report on the progress and impact of previous grant

- Grant requests will only be accepted electronically via our online application system

Grant Process and Checklist

We receive a large number of requests and want to give fair consideration to everyone. Please understand that support in one year does not guarantee support in future years.

Prior to starting the online grant application, please review eligibility, guidelines and documents required to submit a completed application.

- Review “Who Can Apply” – eligibility and guidelines

- Download the Grant Application Checklist and review required documents for submission

- Read “How to Submit a Strong Grant Application” which can be found on page 2 in the checklist above

The grant review and decision-making process takes approximately eight weeks from the grant submission deadline date. Once decisions have been made, all applicants will be notified of the status of their application by email.

Frequently Asked Questions

Who is eligible to apply?

Organizations registered as a 501(c)(3) or have a 501(c)(3) fiscal agent/sponsor may apply. The organization must be in existence for a least 1 year with demonstrable impact.

Who do I contact if I have questions?

Please email the Foundation at foundation@torringtonsavings.bank or complete the Contact Us form.

Do the funds have to be used in a specific geographic location?

Yes. The nonprofit must be located in, or operate in communities within the Foundation’s defined assessment area as follows:

Avon, Barkhamsted, Bethlehem, Bridgewater, Bristol, Burlington, Canaan, Canton, Colebrook, Cornwall, East Granby, Farmington, Goshen, Granby, Hartland, Harwinton, Kent, Litchfield, Morris, New Hartford, New Milford, Norfolk, North Canaan, Plymouth, Roxbury, Salisbury, Sharon, Simsbury, Thomaston, Torrington, Warren, Washington, Watertown, Winchester and Woodbury.

What are the grant cycles and deadlines?

- Spring Grant Cycle opens on April 1 and closes on April 30; awards disbursed in late June

How do I submit a grant application?

All applications must be submitted online. During an open grant cycle phase, applications are available online. Check Grant Cycle status.

How much money can I request?

Most requests supported by the Torrington Savings Foundation fall in the $2,500 – $50,000 range. Your funding request should not exceed what is necessary to execute your project.

Can I submit more than one application in a year?

No. Only one may be submitted in a 12-month period (regardless of grant award status). Support in one year does not guarantee support in future years.

Will the Torrington Savings Foundation consider requests from schools?

No; however, requests for programs offered in schools by nonprofit organizations will be considered.

When do I need to submit a report on an existing grant?

Within one year of receiving your grant award, you are required to report on financial expenditures and activities/progress. Reports can be emailed to the Foundation at foundation@torringtonsavings.bank

If the project or program does not take place, do the funds have to be returned to the Foundation or can they be allocated to another project or program?

Grant funds unexpended or uncommitted at the end of the grant period must be returned to the Foundation or receive approval from the Foundation Board to allocate the funds to another project or program.